Zakat and tax require the actual existence of incentives in special zones

A strategic step to enhance economic transparency

In a significant regulatory step aimed at enhancing integrity and transparency in the investment environment, the Zakat, Tax and Customs Authority in Saudi Arabia has introduced a draft regulation on “actual economic requirements” for special economic zones. This move is intended to prevent the emergence of so-called “shell companies,” which are legal entities that do not engage in genuine economic activity and are often used to evade taxes or benefit from incentives without contributing any added value to the national economy.

The general context within Saudi Vision 2030

This regulation falls within the broader framework of Saudi Vision 2030, which aims to diversify income sources and attract high-quality investments. Special economic zones are a cornerstone of achieving these goals, offering tax and customs incentives to attract global companies. However, the success of these zones hinges on ensuring that investments are genuine and sustainable. Therefore, this legislation emphasizes the principle of “incentives for value,” guaranteeing that beneficiary companies actively contribute to job creation, knowledge transfer, and local economic development, rather than simply serving as fronts.

Key requirements for the actual presence of companies

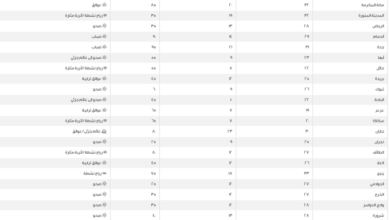

The draft regulations require investors in special zones to meet a set of essential conditions that prove their actual presence, most notably:

- Headquarters and physical assets: The investor must own a headquarters and physical assets appropriate to the nature and size of his business within the boundaries of the economic zone.

- Operating expenses: The Authority has required companies to incur real operating expenses within the region, commensurate with their qualifying activities.

- Human resources: The regulations stipulated the employment of a sufficient number of qualified and full-time employees who actually carry out their work from within the region.

- Management and direction: The management and direction of key activities must originate from within the region, with the necessity of appointing at least one manager residing in the Kingdom, holding board meetings in person within it, and documenting its strategic decisions.

Strict controls on intellectual property activities

The Authority imposed stricter controls on intellectual property activities to prevent their exploitation as a front for tax evasion. It mandated that investors in this sector must have at least 50% of their managers permanently residing in the Kingdom, and submit a detailed business plan justifying the commercial viability of holding intellectual property assets within the region. This ensures that strategic decisions and risk management related to these assets are central to the operations of the regional headquarters.

Expected impact locally and internationally

Domestically, these measures will enhance the integrity of the tax system and ensure the achievement of the desired objectives of special economic zones, namely genuine economic development. Internationally, this step positions the Kingdom among the countries committed to global best practices in combating Base Erosion and Profit Shifting (BEPS), led by the Organisation for Economic Co-operation and Development (OECD). This strengthens the Kingdom's reputation as an attractive and reliable investment destination seeking genuine partners who contribute to its development journey.