Zatka: Deadline for submitting withholding tax forms for December 2025

The Zakat, Tax and Customs Authority (ZATCA) has called on all commercial establishments subject to withholding tax regulations in the Kingdom of Saudi Arabia to expedite the submission of their withholding tax forms for December 2025. The Authority clarified that the deadline for accepting these forms is January 11, 2026, emphasizing the importance of adhering to the established deadlines to ensure smooth business operations and avoid any legal or financial repercussions.

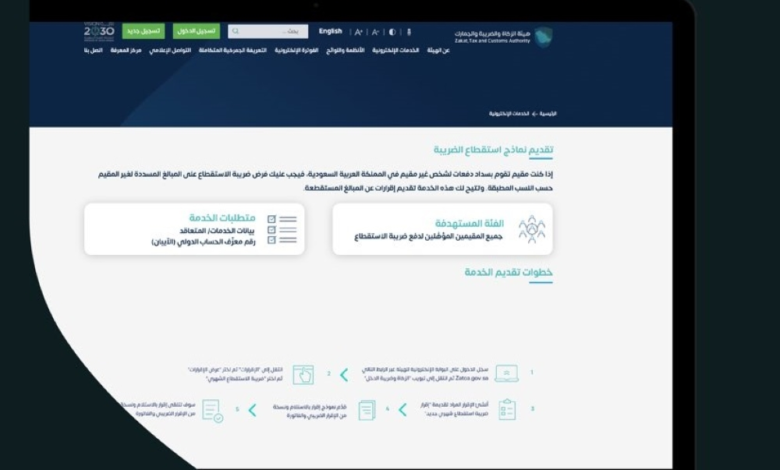

In clarifying its procedures, ZATCA urged taxpayers to utilize the advanced electronic services available on its official website to submit forms and make payments easily and conveniently. The authority warned that late payment beyond the specified deadline will incur financial penalties calculated at 1% of the unpaid tax for every thirty days of delay, starting from the due date. This necessitates that businesses meticulously manage their financial and tax affairs.

The concept of withholding tax and its economic importance

Withholding tax is a cornerstone of the Saudi tax system, levied on all payments made from a source within the Kingdom to non-resident entities that do not have a permanent establishment within the country. This tax is based on the rates and percentages specified in Article 68 of the Income Tax Law, as well as Article 63 of its Implementing Regulations. This mechanism aims to protect the national economy and ensure tax fairness between local and foreign companies, thereby enhancing the investment environment and achieving market equilibrium.

This measure comes as part of the Kingdom's ongoing efforts to develop its financial and tax system in line with the objectives of Vision 2030, which focuses on automation and digital transformation across all government transactions. Over the past few years, the Zakat, Tax and Customs Authority has successfully brought about a qualitative leap in its services, making it easier for taxpayers to fulfill their tax obligations and strengthening the principle of voluntary compliance.

Communication and technical support channels

In its commitment to providing necessary support to the business sector, Zakat and Tax Authority (ZATCA) invites taxpayers seeking inquiries or further information about withholding tax and the form submission process to contact them through their various channels. These channels include the unified call center number (19993), which operates 24/7, as well as the "Ask Zakat, Tax & Customs" account on the X platform (@Zatca_Care), email ( [email protected] ), and the live chat service available on the Authority's website, to ensure that all inquiries are answered and any obstacles that taxpayers may encounter are addressed.